RETAIL BANKING

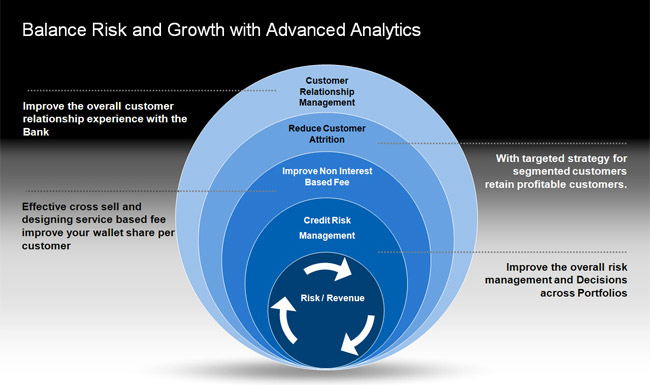

The heart of a successful Retail Banking business practices lies in its ability to completely leverage data and insights to the best extent to drive profitability and manage risk.

Without appropriate profiling and strong strategy management in place Bank’s can easily loose market share and climb default levels very easily. Market behavior and the macro economic factors are serious drivers for profitability and help grow customer base without compromising on Risk Levels. Assessing Risk starts very early in a retail bank business process. Right from campaign design to collections. Predictive Analytics go a long way in assisting banks to leverage trends in data and customer behavior to drive sales and sustain performance.

-

Manage Campaign Design.

-

Execute Targeted marketing campaigns.

-

Simulate Response and Product Performance.

-

Drive Cross Sell / Up Sell.

-

Advanced Profiling and Segmentation.

-

Underwrite Risk at Application.

-

Assess Pricing and Repayment Plans.

-

Always maintain a balance of the Right product pricing with Risk Attributes.

-

Hybrid Models using Bureau Data.

Develop Behavior Scorecards to assess risk at frequent intervals.

Drive Decisions on:

-

Credit Card Plans

-

Over Limit approvals

-

Pricing

-

Securitization

-

Overdraft Limit Management for revolving products

-

Cross Sell/Up Sell

-

Collection Strategies.

-

-

Application Fraud.

-

Identity Fraud.

-

Identify Patters for Fraud Rings.

-

Project Collections Projections.

-

Strategy design for collections queue allocation.

-

Optimize the use of right channel for types of collection buckets.

-

Collection roll rate analysis and segmentation.

-

Design Loss Provisioning at various levels.

-

Using Analytics drive effective "Economic Capital Modeling".