BASEL 2 SERVICE

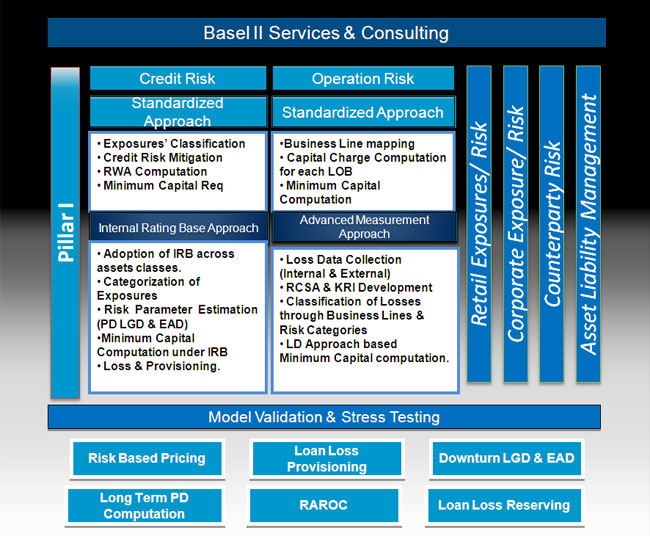

The Basel II recommendations are based on three pillars; Minimum Capital requirement: supervisory review & Market Discipline. The design is to evaluate the risks scientifically and provide incentives to banks to evolve and adopt more sophisticated techniques by means of autonomous risk assessment.

In long term these recommendations by means of various measures would be able to influence Corporate Governance and better credit risk management through full-grown and self assessed needs. Global Metrics assists banks to come up with a very comprehensive Basel framework. Below are the steps that Global Metrics will assist Banks to drive their first use test scenario and further extend to the enterprise. Curabitur gravida.

Gap Analysis(Data Adequacy)

Using advanced cross sell and UP sell models, Insurance companies can optimize the use of low cost channels and target the right customer with the right product. With recent observations and appeal from IRDA to insurers on product miss –sells, there is a certain impact on attrition. Our simple and practical solutions assist in putting a data driven selling process in place.

Modelling Development Process & Methodologies

Using a overall customer contact management framework, Global Metrics assist insurance companies to effectively manage retention programmes using advances segmentation and predictive models. With different treatment to traditional and ULIP linked products organizations can optimize our knowledge in using advanced analytics.

The revised Framework outlines three broad approaches to quantifying pooled PDs.

Historical Default Experience Approach

Statistical Model Approach

External Mapping Approach

Validation of Exisiting Scoring Systems & Retail Pool Creation

Validation of Exisiting Scoring Systems & Retail Pool Creation

Bank already possesses application and behavioural scorecards, the "Validation" of which will carried out to utilize the scores for retail pooling definition design with default non-default flag using statistical tools. In case, if existing scorecards does not meet validation benchmarks, the retail pools will be designed using demographics and transactional history/ information of obligors available with the bank.

Computation of Pooled PD & LGD

For IRB banks, computation of Basel capital ratios for retail exposures would typically needs to be grouped similar exposures that can help categorize borrower account in to pools/buckets that are homogenous with respect to default behavior.

The revised Framework outlines three broad approaches to quantifying pooled PDs.

Historical Default Experience Approach

Statistical Model Approach

External Mapping Approach

Pooled PDs and Pooled LGDs will be used to calculate the IRB capital at the portfolio level. The same approach is applicable to arrive at organizational level capital requirements with further demarcation of sub division in retail assets.

Retail Pooling Documentation

Global Metrics will provide exhaustive documentation over retail pool creation, pooled PD, LGD and EAD computation, IRB capital requirements and RWA for reporting purposes. Vendor will assist bank to qualify USE Test for the portfolio and help to design the future roadmap to regulatory compliances.